Cyber Insurance: Protecting Your Business from the Unknown

Businesses in the modern digital world depend more and more on technology to run smoothly. However, this reliance also brings with it a heightened risk of cyberattacks, data breaches, and other internet-based threats. Cyber insurance is a type of insurance that helps protect businesses from these risks by providing financial protection in the event of a cyber-related incident.

What is Cyber Insurance?

Cyber insurance is a contract that an organization can buy to assist lower the financial risks connected with conducting business online. It is sometimes referred to as cybersecurity insurance or cyber liability insurance. The insurance policy transfers some of the risks to the insurer in return for a monthly or quarterly premium.

Monthly policy changes for cyber insurance are possible due to the dynamic and erratic nature of the linked cyber-risks. In contrast to well-known insurance plans, underwriters of cyber insurance policies have little information with which to build risk models and create the coverages, rates, and premiums of insurance policies.

Origins of Cyber Insurance

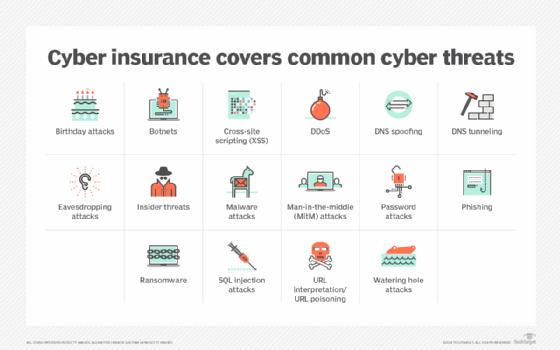

The increased reliance on technology and rise in cyberthreats led to the emergence of cyber insurance in the late 1990s. Over time, it grew to encompass a wide spectrum of cybercrimes, including ransomware, cyber extortion, social engineering assaults, system failures, and business interruptions from cybersecurity disasters. Initially, it concentrated on data breaches and computer attacks.

The financial risks connected to cybercrimes might be decreased with the aid of cyber insurance.

Errors and omissions (E&O) insurance, a different type of insurance that guards against flaws and deficiencies in the services a business offers, is where cyber insurance got its start. For businesses that offer both physical and digital goods, E&O insurance is comparable to product liability coverage. Although several cyber insurance policies have E&O-specific clauses, the majority of providers provide them as separate, different policies.

Who Needs Cyber Insurance?

Although each company has a different risk profile, most businesses might profit from getting cyber insurance. Many different sectors provide excellent candidates for cyber insurance, such as:

- Businesses of all sizes: Cyber insurance might assist organizations that produce, store, and handle electronic data online, such as customer contacts, sales, personally identifiable information, and credit card numbers. Furthermore, e-commerce enterprises might profit from cyber insurance, as downtime due to cyber disasters can result in a loss of revenue and clients. Similarly, any firm that saves client information on a website can benefit from the liability protection provided by cyber insurance.

- Healthcare providers: Because they handle sensitive information and patient data, healthcare organizations are regularly targeted for data breaches and cyberthreats. According to IBM’s data breach research, the typical healthcare hack costs $10 million per year. Healthcare firms must have cyber insurance in place to limit the financial and legal risks associated with data breaches and HIPAA violations.

- Banks and credit unions are also prominent targets for cybercriminals because they handle sensitive client information such as social security numbers.

- Government entities manage a large amount of sensitive information at several levels. Cyber insurance can assist government organizations protect themselves against cyber assaults and ensure the continuity of public services.

- Educational institutions, such as schools, colleges, and universities, keep vast quantities of personal and academic information for both staff and students, making them ideal candidates for cyber insurance.

- Companies with substantial income: Because of the possible financial incentives, businesses with large revenue streams might be attractive targets for hackers. Organizations with a large income base may consider obtaining cyber insurance to protect themselves from the financial losses caused by cyber attacks and data breaches.

What is Covered and Not Covered by Cyber insurance?

In the United States, several major insurance firms provide clients with cyber insurance coverage alternatives. Depending on the pricing and type of coverage, the client might expect to be paid for additional expenses caused by the physical damage or theft of IT assets. These expenses often include fees related to:

- Meeting extortion demands from a ransomware attack

- Notifying consumers when a security violation has happened

- Paying legal expenses incurred as a result of privacy violations

- Hire computer forensics professionals to retrieve compromised data.

- Restoring the identity of clients whose PII was compromised.

- Recovering data that was changed or stolen

- Repairing or repairing damaged or corrupted computers

Cyber insurance policies may not cover:

- Infrastructure problems not triggered by a deliberate cyber attack

- Failure to repair a known vulnerability, such as a corporation that knows a vulnerability exists, fails to patch it, and then gets compromised by that vulnerability.

- The expense of enhancing technology systems, particularly security hardening in systems or applications

- Loss of intellectual property value, such as confidential knowledge, trade secrets, or other priceless intangible assets